With their travel revenue expected to reach $12.2 billion in sales – compared to online travel agencies such as Expedia: $9.2 billion and The Priceline Group: $9.2 billion – it’s no secret that Google has become a significant and influential force in the digital travel space. Just look at Google’s Trips app launched September 2016; it serves as a handy tool for travelers after they have found and booked flights.

Back in 2011 when Google Flights was launched, it was all about “the takeoff, not the final destination,” to paraphrase CNN Travel. Google wasn’t responsible for the transactions (or so the thinking goes); it pursues data and traffic – and passes that traffic to customers.

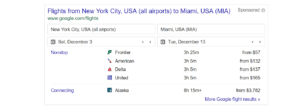

Example of Google Flights Interface

But here’s the paradox: Today, Google Flights moves airline touchpoints with travelers further and further down the purchase funnel, meaning less airline brand visibility for passengers, and therefore less brand loyalty. And why does Google do that? Because Google always focuses on delivering a great user experience, and today’s reality is that the user booking experience is better on major online travel agency (OTA) sites than it is on airlines’ own sites, for the most part.

For several years, we’ve anticipated Google becoming the dominant force in the travel market, and we continue to urge airlines to create the types of search-informed digital infrastructures that will enable passengers to find and book the flights they want directly from the airline website.

Google would be happy to hand off traffic to airline websites if the booking flow was seamless and user experience was first-class, but they will continue to defer to OTAs as long as their user experience is superior, and will itself continue to explore going deeper into the purchase funnel. As a recent article in Skift mentions “Google sees itself as an “answer engine” and “connector” to the right partner at the correct time,” we’re clearly not alone in our thinking.

This has also been proven in their recent target of travel marketers to purchase native programmatic ads – currently being tested by Hilton – that allows them to upload their current creative, text and headlines of a campaign to then be adjusted by Google’s ad platform to fit individual publisher sites and apps.

Airlines must aspire to achieve that higher level of user experience — the need to increase digital power, drive direct-channel growth and own their customers has never been greater. Airlines must remain focused on solutions that build first-class user experiences and long-term, profitable relationships with their customers – just as Google does.